Give us some more FAR and air rights!

The French may be right in their approach to relaunch real estate developments, construction and generally add inventory in multifamily, office and retail sectors.

A recently published law (March 20th 2012) allows for a temporary increase of building rights. In this case 30%. While the law is national in theory, it lets local authorities decide if they will allow vertical expansion to happen.

What are the goals behind this measure:

– relaunch development along with the architecture and construction sectors of the economy.

– create jobs in the above mentioned sectors.

– generate additional real estate taxes as a result of the newly created buildings and structures.

– generate an additional supply of housing and offices.

Could this be done in the US and in NYC? The answer is yes and it needs to be done.

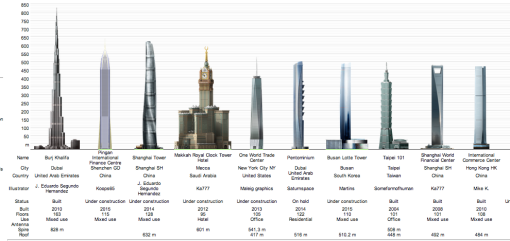

Appart from generating jobs and sustaining construction and architectural jobs in the city, increasing real estate tax revenues for the long term, it will have a positive impact on the city. New housing and office inventory is something really needed. NYC needs to stay competitive compared to other great cities in the world. Construction of new and technologically advanced buildings is booming in Asia, South America, and in the Middle East.

Many developers and building owners today are not taking action.Why? Obsolete buildings are not demolished because it is not economically feasible for a developer, but this can change with higher FAR and additional air rights.

We are always complaining about the lack of space in the city. It is time to take action. While it does not require a lot from the Mayor’s office in terms of legislation, a measure as simple as giving 30% more FAR for the next two years might just ensure a bright future for NYC.

For once, the French might be right.

Come on! Give us some more FAR and air rights!

Peter Videv is a Senior Advisor at Sperry Van Ness in New York City.