We are in the middle of a recession. Many economists forecast the recovery to be slow, and as for every recovery it’s not going to happen without job creation.

As mentioned in the first part of this post, we are also embarked in social change regarding the workplace. This combination of social and economic changes makes any business really sensitive about real estate related costs, whether it is owning or leasing a space.

Commercial Real Estate landlords need to reinvent themselves and adapt in order to stay profitable, as they cannot carry forever big chunks of empty space in their buildings. They still pay taxes, utilities, etc., even on vacant space.

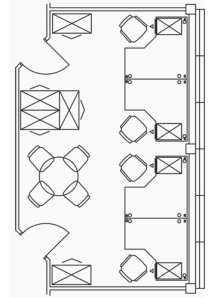

They can embrace change by becoming more flexible to short term office leasing. Some companies are specializing in “executive” offices and/or flexible office space, but very few landlords are doing this on their own. Lots of businesses are restructuring and rethinking the way they use office space, sometimes needing less restrictions than he usual 5-10-15 year leases offer. They need flexible short term solutions to adapt quickly to market conditions.

By offering flexible office space on a hourly, daily or monthly basis, landlords will be able to capture tenants that are otherwise not willing to commit to a long term lease. By taking the flexible office solution one step further, landlords can even offer their space on a 24/7 basis, optimizing to the maximum the use of their space. Why? Because most of the businesses looking for flexible office space are not the traditional 9 to 5, 5 days a week corporate type.

As an example, eEmerge, an office business center subsidiary of SL Green Realty, has just moved into the 11th and 12th floors of SL Green-owned 1515 Broadway, the famous Times Square home of Viacom and site of MTV studios. The 54-story, 1.9 million-square-foot building, which counts Viacom as its main tenant, will now serve as eEmerge’s main headquarters. The affiliate group, which focuses on flexible and short-term office space, will be utilizing a total of 65,000 square feet in the 72 percent occupied building.

As social change happens and businesses have the technological tools to work from anywhere, landlords, as business owners cannot ignore the need for flexible office spaces. Some business like Eric Vidal’s iCube NY are even organized without a formal office space.

Operating an office building remains a profitable business as long as you focus on maximizing your income and reducing your expenses.

In the third part of this series, we will look at solutions to reduce expenses on Commercial Real Estate. Stay plugged!

40.747179

-73.983354

Peter Videv is a Commercial Real Estate Advisor with Sperry Van Ness in New York City

Peter Videv is a Commercial Real Estate Advisor with Sperry Van Ness in New York City